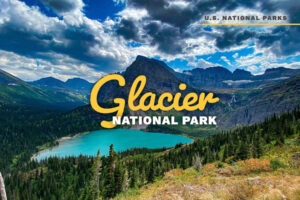

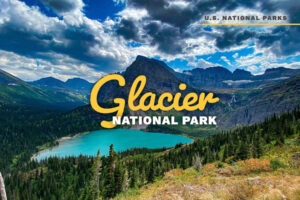

Glacier National Park

In the glacier-carved peaks and valleys of Montana’s northwestern wilderland, Glacier National Park stands as a testament to nature’s grandeur, truly living up to its

In the glacier-carved peaks and valleys of Montana’s northwestern wilderland, Glacier National Park stands as a testament to nature’s grandeur, truly living up to its

So you bought the RV you were dreaming of. That’s great! But now comes the important part: maintenance. Whether your vehicle of choice is a

Arches National Park enchants visitors through its beautiful arches, stunning sunsets, family-friendly hiking trails, and more. When visiting this national park be sure to take

From digital navigation to campground data, the amount of information available at our fingertips is nearly limitless with the use of mobile phones. The ROUTE

Yosemite National Park is known for more than just the impressive granite rock formations. Visitors revel in pristine lakes, flowing waterfalls, dome rock formations, magnificent

For many, their trailer or motorhome is their home away from home. It is important to take the proper steps toward protecting your investment by

The United States National Park system offers travelers several opportunities to explore unique landscapes, view beautiful scenery, and encounter a wide variety of wildlife. Yellowstone

Deciding to purchase a recreational vehicle is a big investment for new and experienced RVers alike. If this is your first RV purchase, the varying

Did you know that St. Louis is the largest city on Route 66 and that the Gateway Arch is America’s tallest monument? Well, you do